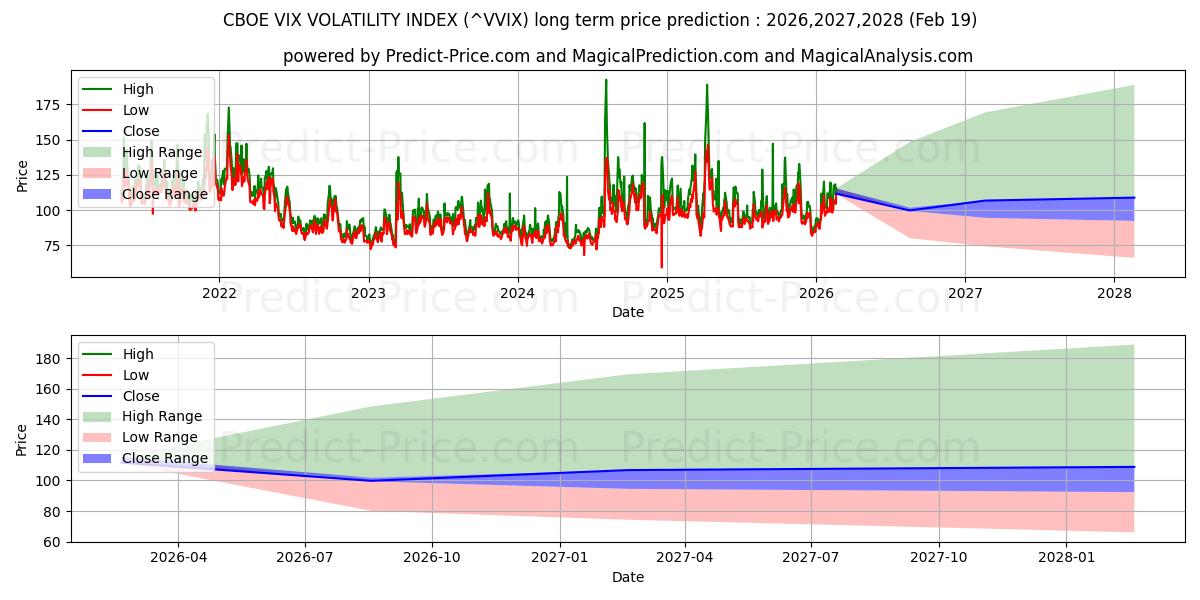

Maximum and minimum CBOE VIX VOLATILITY INDEX long-term price forecast for 2026,2027,2028

| Period | Action | Trend | Status | Action & Trend & Status | Ceiling price | Floor price | Ceiling & Floor |

|---|---|---|---|---|---|---|---|

| 6 Months | Neutral | Neutral -8.43% | Loss -28.26% | Neutral Neutral:-8.43% Loss:-28.26% | 148.3609 | 80.1126 | 148.3609 80.1126 |

| 1 Year | Neutral | Neutral -13.85% | Loss -33.44% | Neutral Neutral:-13.85% Loss:-33.44% | 169.3482 | 74.3270 | 169.3482 74.3270 |

| 1 Year | Neutral | Neutral -10.97% | Loss -40.8% | Neutral Neutral:-10.97% Loss:-40.8% | 188.7910 | 66.1094 | 188.7910 66.1094 |

Useful Tips: To make the most informed decisions about investing in CBOE VIX VOLATILITY INDEX (^VVIX), we highly recommend visiting the 'MagicalAnalysis' and 'MgicalPrediction' websites. They also provide signals for free. 'MagicalAnalysis' provides signals based on technical analysis and various strategies for free. 'MgicalPrediction' provides signals based on various AI models for free.

CBOE VIX VOLATILITY INDEX (^VVIX) price forecast charts until 19 Aug 2026

CBOE VIX VOLATILITY INDEX (^VVIX) price trend forecast until 19 Aug 2026

CBOE VIX VOLATILITY INDEX (^VVIX) profit and loss prediction until 19 Aug 2026

The prediction chart of the highest and lowest price of CBOE VIX VOLATILITY INDEX (^VVIX) until 19 Aug 2026 Forecast chart of the highest and lowest 19 Feb 2026

CBOE VIX VOLATILITY INDEX (^VVIX) price forecast charts until 19 Feb 2027

CBOE VIX VOLATILITY INDEX (^VVIX) price trend forecast until 19 Feb 2027

CBOE VIX VOLATILITY INDEX (^VVIX) profit and loss prediction until 19 Feb 2027

The prediction chart of the highest and lowest price of CBOE VIX VOLATILITY INDEX (^VVIX) until 19 Feb 2027 Forecast chart of the highest and lowest 19 Feb 2026

CBOE VIX VOLATILITY INDEX (^VVIX) price forecast charts until 19 Feb 2028

CBOE VIX VOLATILITY INDEX (^VVIX) price trend forecast until 19 Feb 2028

CBOE VIX VOLATILITY INDEX (^VVIX) profit and loss prediction until 19 Feb 2028

The prediction chart of the highest and lowest price of CBOE VIX VOLATILITY INDEX (^VVIX) until 19 Feb 2028 Forecast chart of the highest and lowest 19 Feb 2026

Users forecasts for CBOE VIX VOLATILITY INDEX (^VVIX)

What is your prediction?

In this section, you can easily predict without user registration. See also other users predictions.